State Budget Contains Big Pension Improvements for Retirees

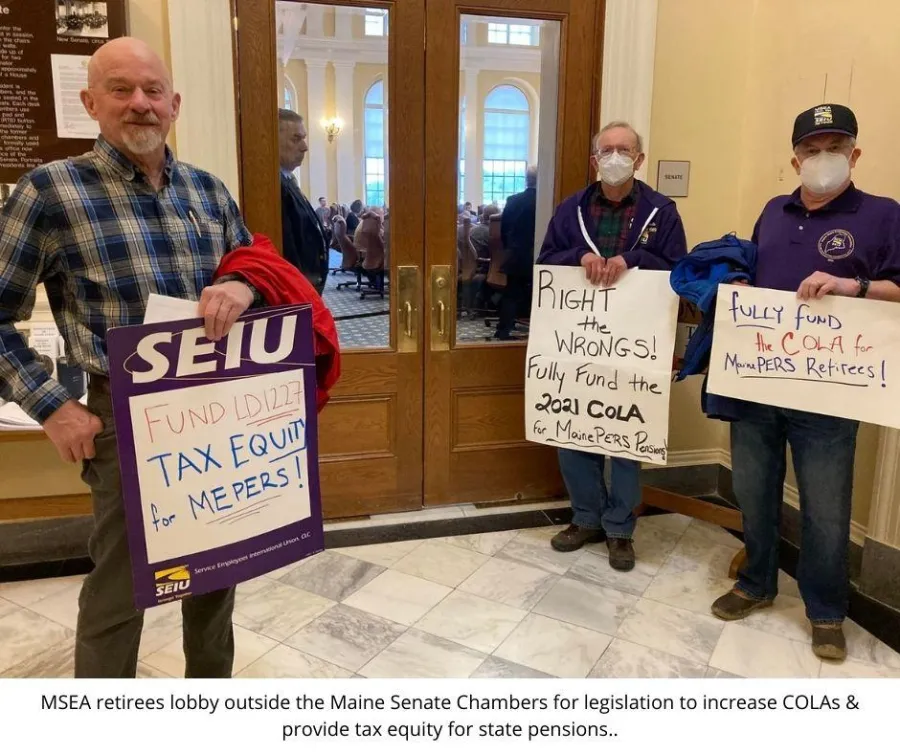

Last week, Governor Janet Mills signed a supplemental budget that includes several provisions that will help retired workers. Retired state employees, teachers and retirees organized, testified in front of committees and wrote letters this session urging our elected officials to repair damage done to state pensions by previous administrations that have broken promises and shortchanged retirees struggling on fixed incomes. Their hard work has paid off!

“As far as retiree issues go, this is the biggest win that we’ve had in the State Legislature in a very long time,” said MSEA SEIU 1989 retiree Penny Whitney-Asdourian. “I am exceptionally grateful to our union staff and the membership who devoted their time to making this happen — for the staff who organized and helped lead the way and the members who took their time to go to the State House, testify before the Appropriations Committee and make sure that we were heard. And this year we were heard.”

This budget is an important step to reversing the devastating cuts made to state pensions by former Governor LePage and the Legislature back in 2011. It makes a number of improvements to MainePERS retirement pensions, including:

- Increasing the 2021 cumulative cost of living adjustment (COLA) from 3 percent to 4 percent. While inflation was 5.4 percent last year, retirees only received a 3 percent increase last summer because the LePage administration reduced the COLA from 4 percent to 3 percent in 2011. Bringing the COLA back to 4 percent will help retirees as members fight to keep pension benefits on par with inflationary increases.

- Adding an additional 2.4 percent to the pension base. This will help ensure benefits do not deflate for current retirees and other workers in the MePERS system when they retire.

- Exempting the first $25,000 in pension income from state income tax for retirees beginning next year. Currently the first $10,000 of pensions are exempt from taxes, but that $10,000 is reduced by any gross Social Security benefits that workers in the state pension system receive. If you get $4000 in Social Security benefits prior to your Medicare payment, that $10,000 gets reduced by $4,000, making only the first $6,000 exempt. For years, public employees have fought to exempt state pensions from income tax because Social Security benefits are not taxed in Maine and most of these retirees do not receive Social Security.

- Increasing the tax exemptions on pensions by $5,000 per year until it matches the exemptions for Social Security benefits.

"The people who were impacted most by the 3 percent cap on COLAs and the state tax are the people who were the longest term employees and they don’t receive Social Security,” said retired MSEA member Jane Gilbert. “If you were a clerk typist making $40,000 a year on your retirement because you worked 40 years, you’re getting nailed with your cap getting reduced every time there’s a raise and you’re not getting an exemption on your state income tax.”

MSEA President Dean Staffieri noted that these changes will help retirees now and will compound in future years, improving retirement benefits for all participants in the state retirement plan. The original budget proposal included a one-time 2.4 percent cost of living adjustment that cost $14 million, but because of union members organizing and advocating for themselves, they got a much better deal with $105 million for MainePERS pension improvements.

“Make no mistake — the gains we made in this supplemental budget only happened because so many members showed up and made their voices heard,” wrote Staffieri. “We packed the halls of the State House, we made calls and wrote emails, and we made the Legislature listen to our concerns. Now, we’ll have to build on this momentum to ensure we can continue to make progress with a pro-worker, pro-union Legislature in 2022.”