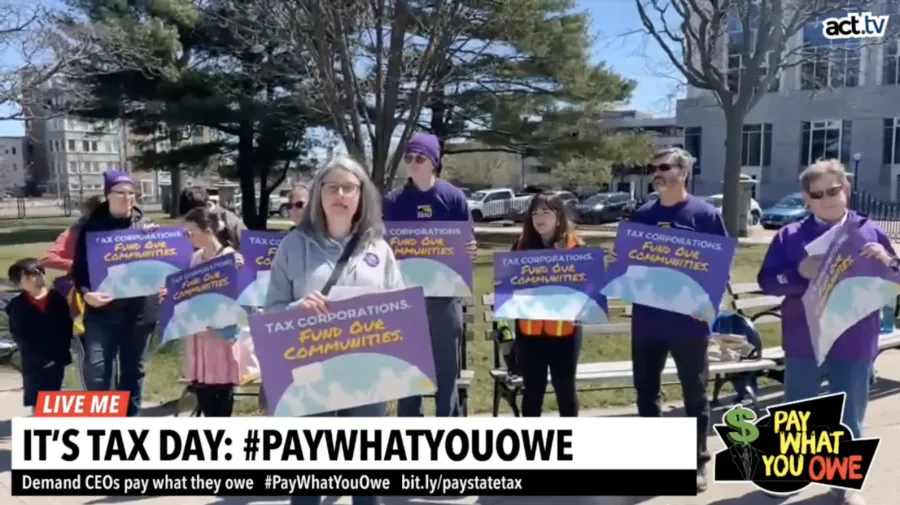

MSEA-SEIU 1989 Members Demand Corporations Pay What They Owe

This past Monday (Tax Day), members of the Maine Service Employees Association SEIU 1989 joined workers throughout New England to demand corporations pay what they owe for public services in our communities and stop shifting tax responsibilities onto working families and retirees.

“Revenue paid through taxes is how we pay for things that benefit all of us like schools, roads, parks, public safety and clean water,” said Maura Pillsbury of the Maine Center for Economic Policy (MECEP). “Our tax code should be an agreement we make with each other to ensure our needs are met by everyone chipping in their fair share. When wealthy corporations break that promise by not paying what they owe, our communities are left paying the price. We need to push back against corporate tax loopholes and accounting schemes now to make sure our communities can afford to prosper in the future.”

The Tax Day event coincided with a new report by the Economic Policy Institute showing corporations are paying little if any in corporate income tax revenues to states, threatening a range of public services our communities count on. In seven states, more than 60 percent of corporations pay no state corporate income tax, according to the report.

The group highlighted two bills that would close corporate tax holes that have passed the Maine Legislature and are awaiting the Governor’s signature. LD 428 would move forward a plan to prevent companies from hiding their profits offshore. Corporations avoid paying $52 million in Maine income tax by using tax havens.

LD 1129, sponsored by Rep. Ann Matlack (D-St. George), would crack down on big box stores that challenge local tax assessments to get out of paying millions of dollars in property taxes. Known as the “dark store” tax scheme, companies like Walmart will argue that their retail properties should be valued the same as abandoned shopping centers that have lost economic value.

A 2019 MECEP report found that of the 25 Maine towns with the highest retail sales, 17 had big box stores appeal their property tax valuations. The analysis further found that valuations were requested to be reduced by 34% on average. LD 1129 would ensure that such stores are assessed the same as other open facilities.